“Improvements to enshrined ESG values are reflective of a thoughtful management team, whilst helping any business to retain top talent and win customers. What’s more, we’ve found in our portfolio that these companies are likely to be growing faster”, outlines Investment Associate, Francis Ireland.

Prior to joining the Gresham House Ventures (GHV) team, I spent three years in our Forestry business. Gresham House is one of the top ten natural capital investors globally; an asset class where financial value is intrinsically linked to the impact you deliver. In precis, investors financially benefit from planting trees and, in some cases, the generation of carbon credits, while society benefits from the carbon captured as they grow.

Growth capital is no different, a library of research exists that demonstrates that companies with embedded environmental, social and governance (ESG) values outperform their peers that don’t (1). A few years ago, in conjunction with our group wide Sustainable Investment team, we began to monitor ESG factors at a portfolio company level (see our latest 2023 ESG Survey results).

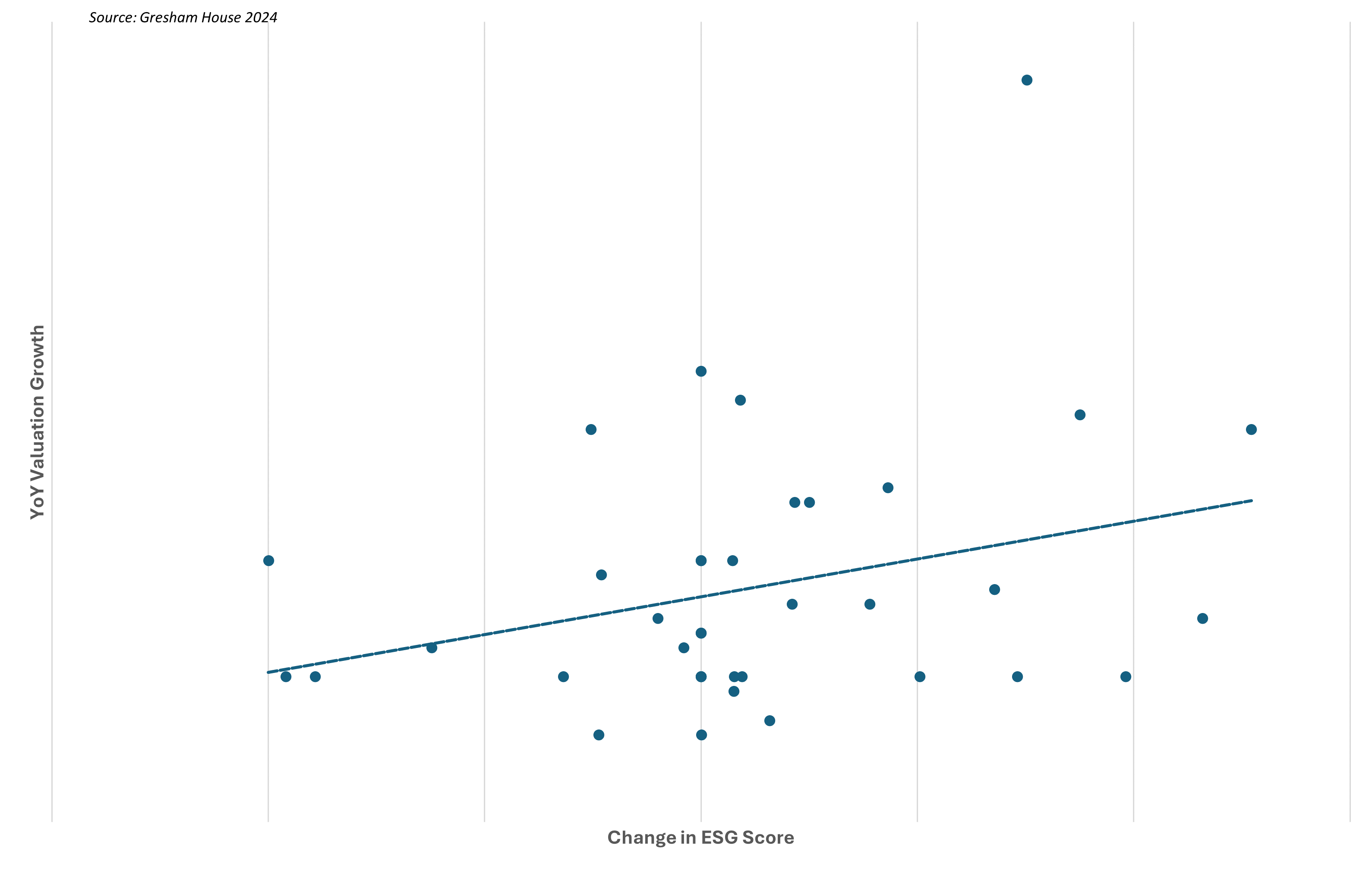

While still at an early stage, initial observations serve to support the positive relationship between improvements in ESG values and shareholder value, as shown in the chart (left). As time goes on, and the sample size within the portfolio grows, GHV will continue to monitor this relationship for further insight.

GHV hold over 70 investments across a range of sectors and stages, with a typical holding period of six years. Research shows that improved financial performance due to ESG becomes more marked over longer time horizons, so it’s important for firms to start their journey earlier to maximise the financial impact. In many ways, it’s easier to embed positive ESG practices at an earlier stage in a business’ development so that it becomes part of the fabric and identity as it scales.

Critics would argue that causation and correlation are not always agreeable concepts, and they would be right. Scale and sector, alongside a variety of other factors, can influence both the improvement in ESG practices and the financial performance of companies. However, a wealth of academic research documents the direct causation which our initial analysis serves to support.

Looking under the bonnet of this relationship reveals further insights. A core growth driver for any investment lies in the defensibility of its product offering in the market. Cynical or not, an approach to ESG can help to provide a defensive moat around a company’s offering, constituting consumer goodwill. In most markets commoditisation, or a race to the bottom, is a core business risk but ESG values can give consumers food for thought, in some cases literally, just look at the price differential between free-range and battery eggs.

Whilst sustainability engenders consumer focused benefits, ESG values can help to attract and retain top talent at a startup, particularly amongst a younger demographic. A Totaljobs survey found that 50% of respondents between 23 and 28 would consider quitting their job to work for an organisation they considered to be more environmentally friendly than their current one (2). ESG values are usually reflected in a variety of focused initiatives, covering a wide range of employee provisions. With small and dedicated teams, the conditions provided to an employee directly affect their motivation, happiness, and development. Positive working environments foster success, more pronounced in growing companies where the personal accountability for certain workstreams is so much greater.

Further, the composition and performance of a board is critical to a scaling business’ success. They provide strategic direction, market intelligence and crucially, experience. The board is at the heart of great governance, and when functioning as it should, provides an invaluable resource for value creation. As a specialist in the scale-up stage, GHV places significant importance on shaping and improving the board, leveraging our in-house talent management function to aid portfolio companies. For us, it is no surprise to see this positive relationship, where improving governance can consequentially improve the delivery of a business’ strategic plan.

Dilution of founder time can quickly kill a growing company as it evolves and adapts to a dynamic and challenging market environment. Self-reflection and awareness are key tools in any founder’s workshop to abate the competitive environments in which they operate to not only survive but to thrive. At GHV we find that an improvement in ESG values is an indication that these management teams are reflective and strategic. In the end, this will be to the benefit of their employees, their board, and ultimately, their shareholders.

Sustainability and our investment process

The chart below details how sustainability is weaved into the pre-investment process and post-investment value creation plan for portfolio companies under Gresham House Ventures’ ownership.

We work to help shape how ESG practices are enshrined into the operating models of those businesses that we invest into, providing in-house expertise via our team of investment professionals and dedicated ESG experts.

1. NYU Stern

2. Totaljobs

Francis Ireland

Investment Associate

Related thoughts

10 December 2025