We are pleased to share our ESG survey for 2023, which improves our understanding of how the unquoted investments held within our portfolios are responding to relevant ESG risks and opportunities and how these are considered as part of their operations.

Our investment approach

Governance has historically been the most important ESG factor in our investment processes. Board composition, governance, control, company culture, alignment of interests, shareholder ownership structure, and remuneration policies are important elements that will feed into fund managers’ analysis and the company valuation.

Environmental and social factors are assessed as risk factors during due diligence to mitigate companies that face risks that cannot be mitigated through engagement and governance changes. Our investment strategy focuses on companies operating in parts of the economy that benefit from long-term structural growth trends and in sectors where we possess deep expertise and networks.

2023 results

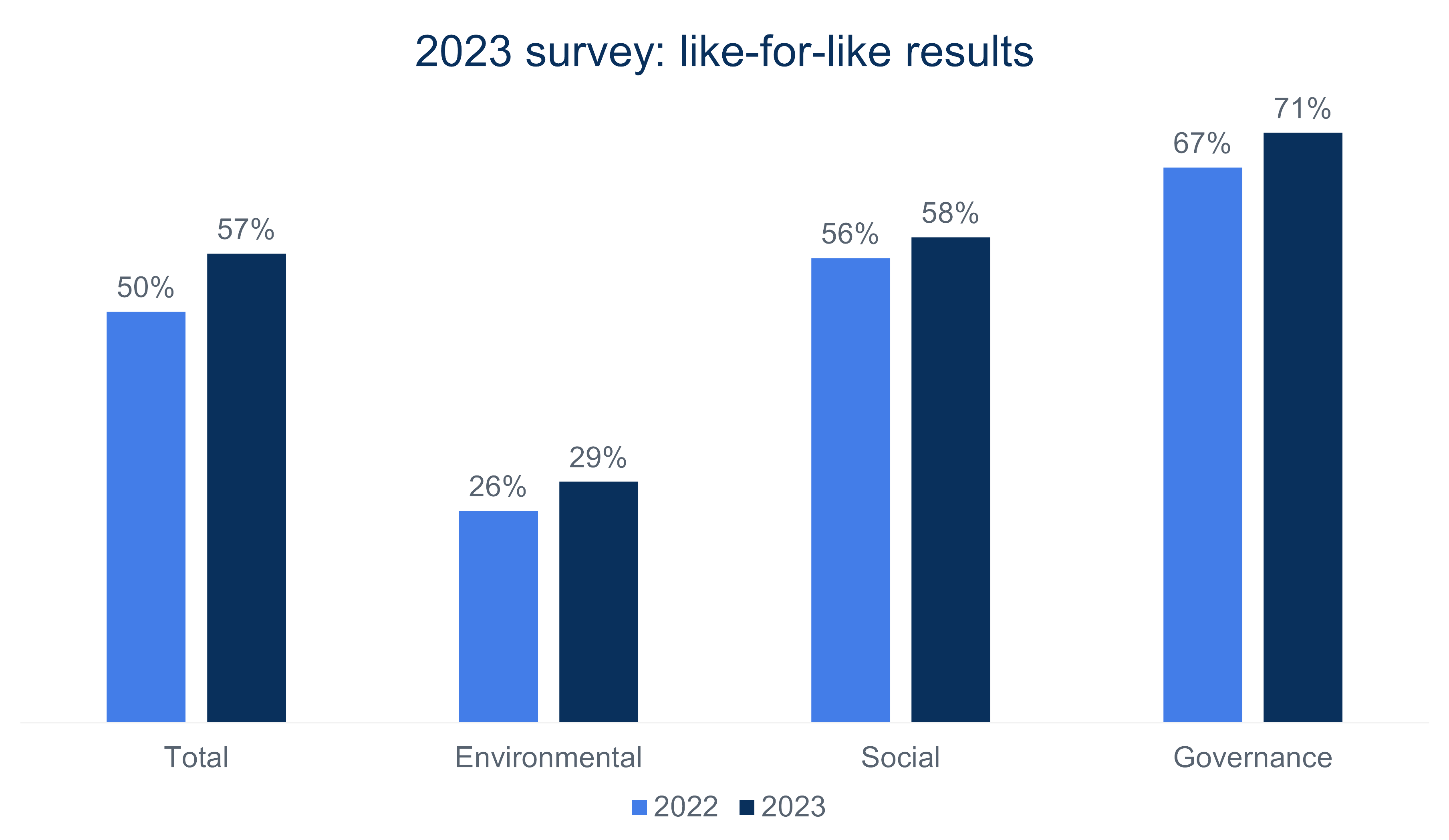

We had a 75% response rate of the 60 companies that we surveyed. Overall, companies scored an average of 52% in 2023 (vs. 48% in 2022). On a like-for-like basis (i.e. excluding new investments and investments exited in 2023), companies scored an average of 57% in 2023, 7 percentage points higher than 2022.

While the survey used a scoring system, a company’s score does not pass judgment on the response. It is an indication of the proportion of suggested initiatives and policies that the business has adopted or is intending to adopt over the next 12 months.

🌍 Environmental: key themes

Companies are taking increased action on driving efficiencies across their business. The proportion of companies that have implemented initiatives to reduce their energy and carbon consumption increased by 6 percentage points (pp) in 2023 on a like-for-like basis.

Interestingly, companies that have calculated their carbon footprint or set a formal net-zero strategy remained broadly flat year-on-year. This suggests that while companies are focused on reducing their energy consumption (thereby reducing operating expenses), they are yet to formalise these behaviours.

We note that in 2024, 27% and 16% of companies plan to measure their carbon footprint and set a net-zero target respectively.

🤝 Social: key themes

Portfolio companies have focused on introducing and improving core diversity, equity and inclusion (DEI) initiatives in 2023. Overall, total workforce gender diversity improved by 4pp year-on-year on a like-for-like basis, with senior management gender diversity improving by 3pp to 26% female.

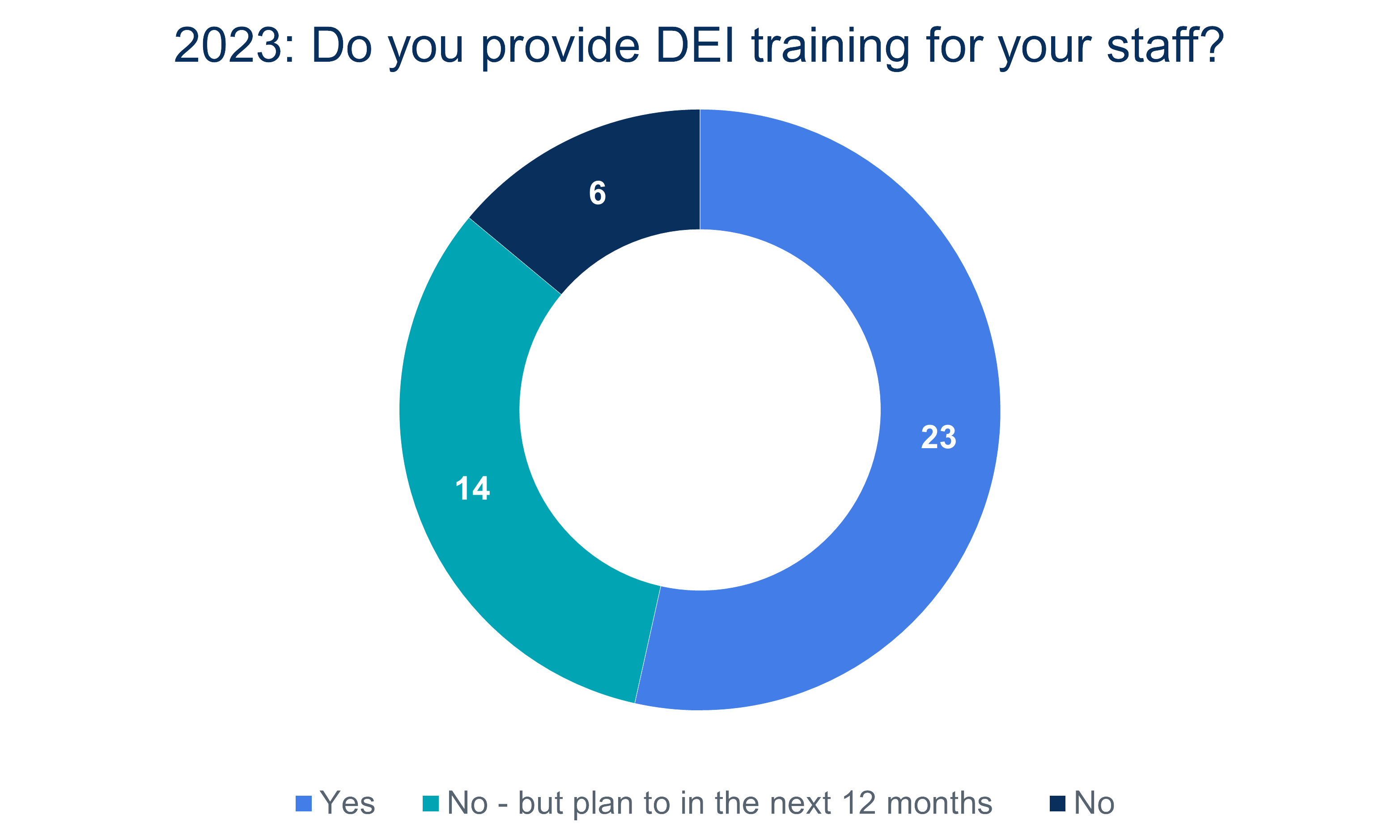

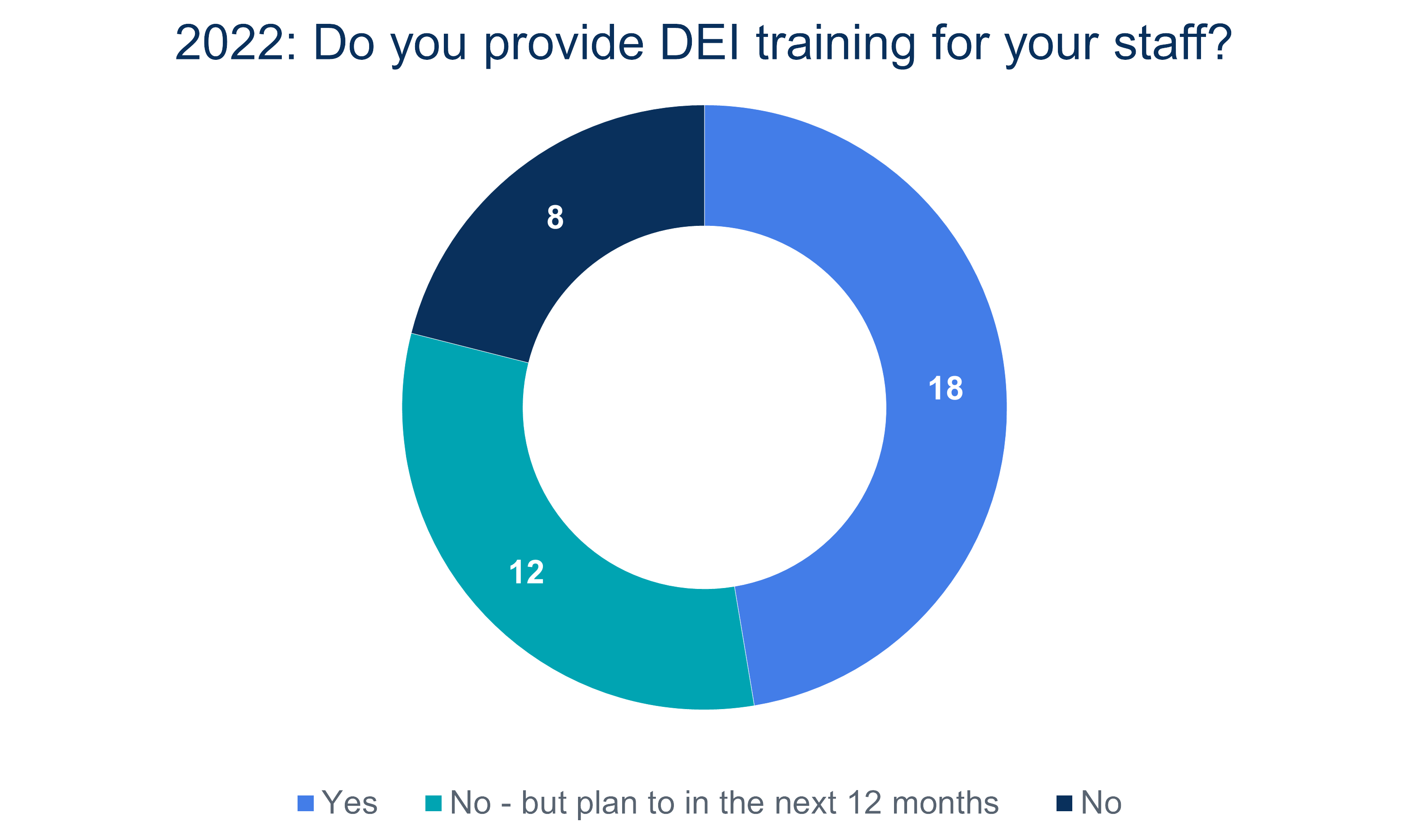

Scores for staff wellbeing and improving and encouraging DEI improved by 4pp year-on-year on a like-for-like basis. Notably, the proportion of portfolio companies offering annual DEI training to all staff increased by 7pp, with 86% of companies either offering training or planning to do so over the next 12 months.

📋 Governance: key themes

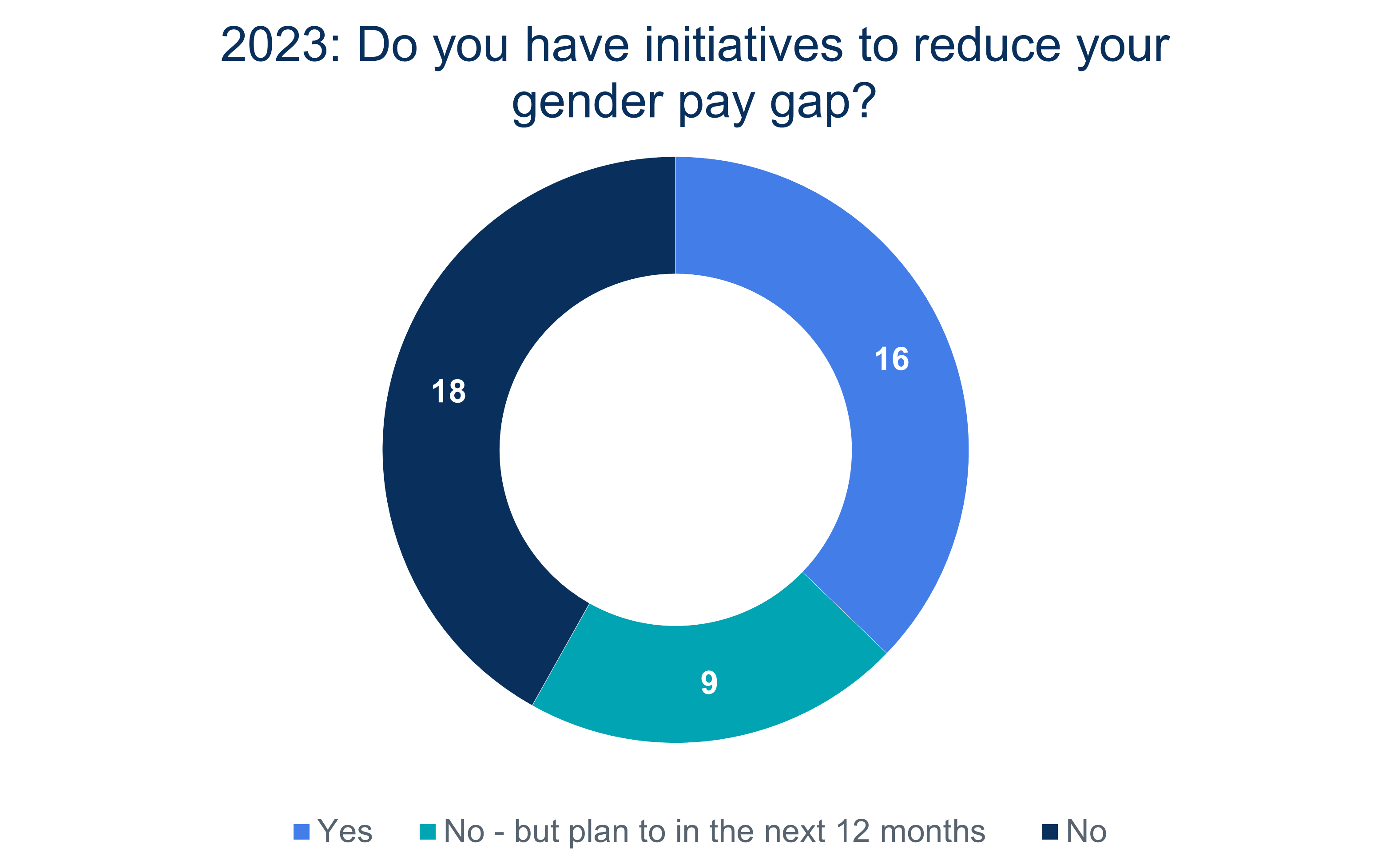

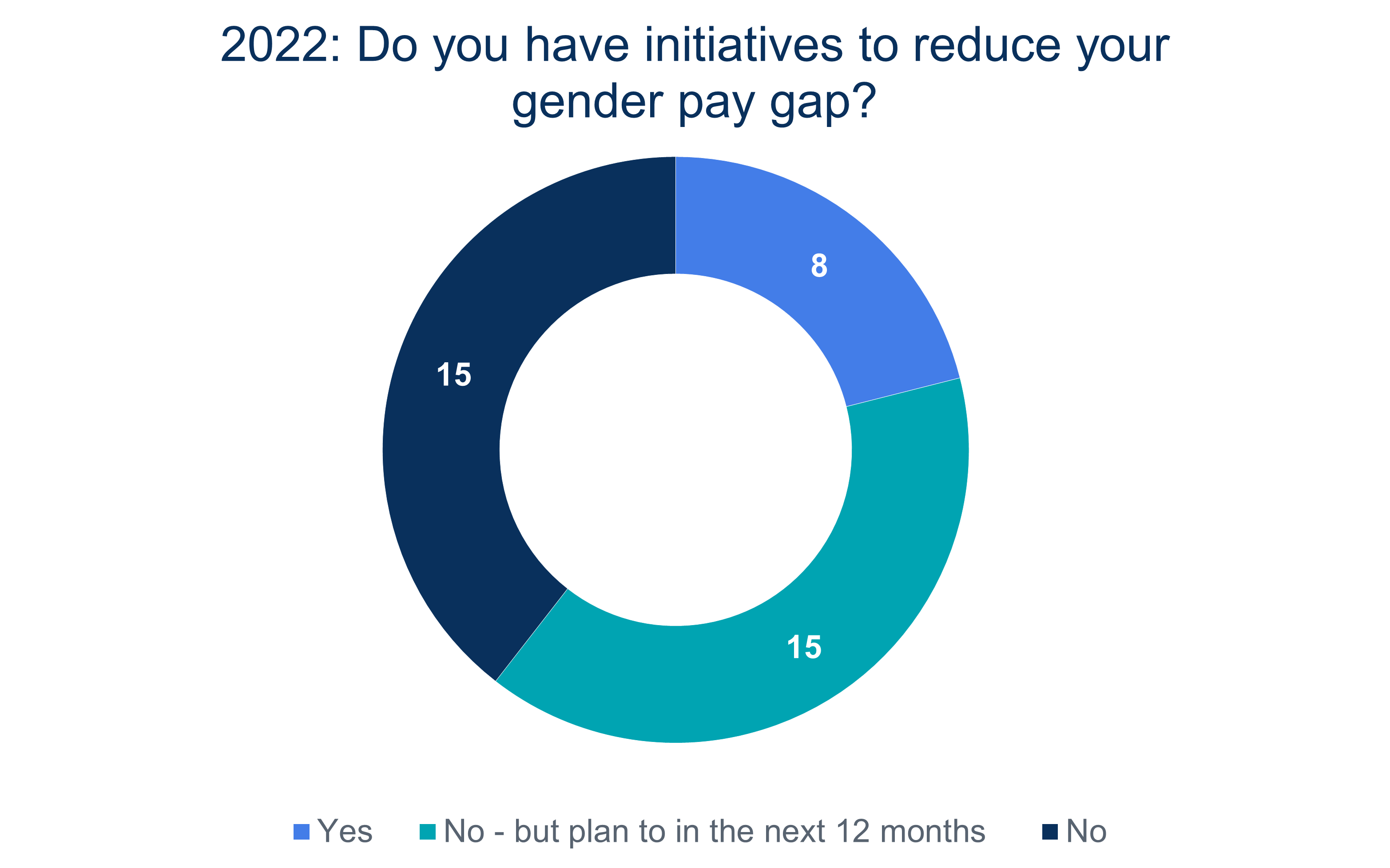

Governance scores increased across the board in 2023 vs. 2022 on a like-for-like basis. The biggest increase was within fair and equal pay, where scores increased by 9pp on average. Within this, the proportion of portfolio companies that have introduced initiatives to reduce their gender pay gap increased by 16pp to 37% of companies.

Corporate policy scores increased too, with 34% of companies with an ESG policy in place, an increase of 6pp on 2022.

Next steps

The survey helps us to develop an understanding of how portfolio companies think about ESG, what ESG data is already being reported on and monitored, and how companies are progressing on their sustainability journeys.

The results of the survey will form the basis of meaningful ESG engagements with our unquoted portfolio companies that we will have over the next 12 months.

Joe Krancki

Investment Director